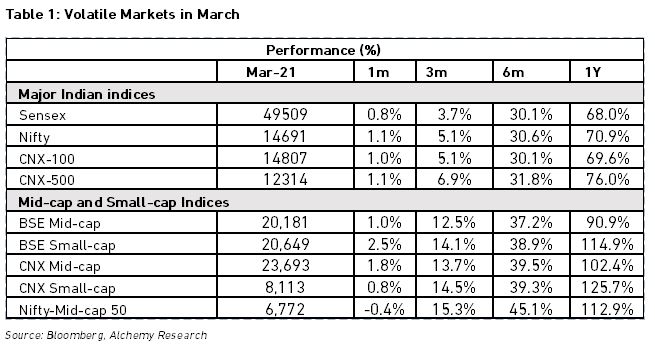

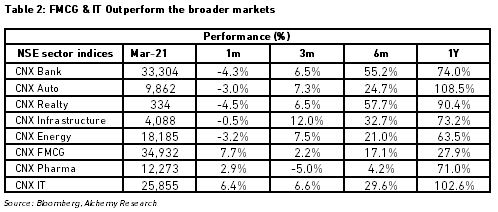

Equity Market Outlook - 15 Apr 2021

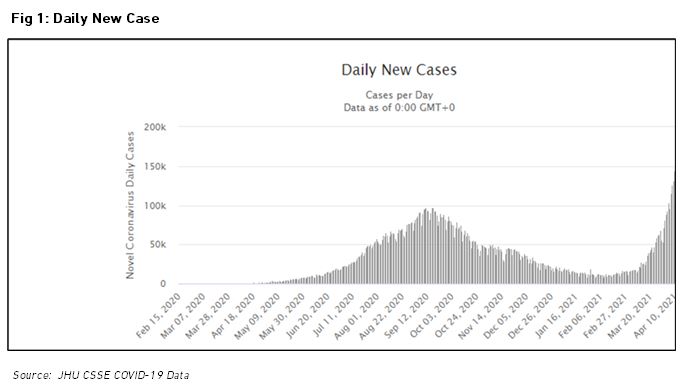

We are now faced with a sudden surge of Covid cases, especially in Mumbai and Maharashtra. We hope that you and your loved ones are safe and healthy. We urge you to be careful and observe the necessary precautions – wearing masks, washing hands frequently and observing social distance.

The new Covid surge and the partial lockdowns are certainly a worry. Unlike last year, however, we see no case for panic. The lockdowns are less severe, the markets realise that this is temporary (from last year’s evidence) and strong monetary and fiscal stimuli would backstop the negative macro impact. We have already seen a more sanguine reaction from the market, a week into the Mumbai lockdown – we see no change for that to change. We remain constructive on the markets and are pivoting our portfolio to cyclical sectors over defensives. Any deep correction would be an entry opportunity for investors.

Covid Surge

We had flagged the rising Covid cases as a worry last month, but the surge has taken us by surprise. The pace of new infections does raise the risk of a delayed macro recovery. A national lockdown looks unlikely, but localised lockdowns have already started – Mumbai is a case in point. This could impact consumer behaviour with on discretionary consumption and the recovery in “unlock trades”, like travel, tourism, out-of-home consumption, physical shopping could get delayed by 1-2 quarters, depending on how soon the infection rate is controlled.

We, however, believe that this will be temporary. The new wave seems to be less lethal (though more virulent), with a higher share of patients being asymptomatic or exhibiting relatively mild symptoms. Moreover, the vaccination drive is picking up pace and there should be widespread coverage in 1-2 quarters from now. The near-term outlook does appear challenging, but we expect a strong recovery in 2HFY22. Overall, we think that any sharp corrections in companies with strong brand franchises and market leadership would be an opportunity.

Reporting season – key issues

The 4QFY21 earnings releases commences in early April. This should be an interesting quarter with several macro pressures and tailwinds at play – we are watching for some key trends in our portfolio companies and overall investment universe.

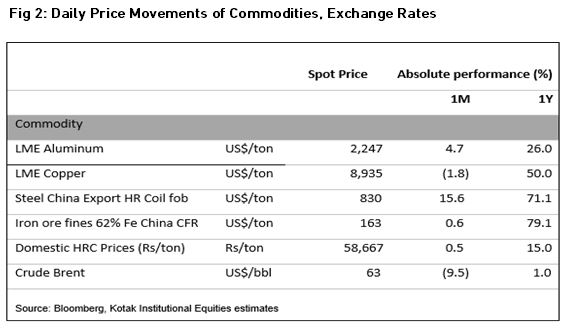

Commodity prices

Commodity prices – metals, crude – have appreciated sharply over the last few quarters. This is, obviously, a worry for margins in the consumer sector. Companies should be able to pass some of the input cost inflation via price hikes but would still have to absorb some of it through lower margins. Given that most companies have already pared fixed costs during Covid, there should be some negative impact on margins in FY22. The 4Q results may not reflect all of this pain (some of it hits with a lag), but this remains a headwind across the consumption space. Strong companies, with market leadership and resilient brands, should be able to counter this over the coming quarters with accelerated premiumisation.

Resilience of demand

The speed in rebound of consumer demand surprised most analysts as the economy normalised, post-Covid. The resilience of this demand will be tested in the coming quarters as the economy slowly normalises. The 4Q results, as such, will likely show this strength – but forward commentary from managements during the earnings announcements would give us a better idea of how FY22 is shaping up. We believe that the demand will be resilient and is likely to deepen towards the bottom of the pyramid. This is a key factor in driving FY22 earnings upgrades.

Sustainability of cost improvements

Cost management was one of the remarkable facets of the FY21 performance, across companies and sectors. This was in response to the demand collapse due to the pandemic and the subsequent lockdown. The 4Q21 results will give us some colour on the extent to which these costs savings are sustainable, as the economy returns to normal and the need for investing in the respective franchises starts to come back. Our base-case assumption is that fixed costs will bounce back in FY22, though some of the cost advantages gained in FY21 could be sticky. This dovetails with our worry on the impact of commodity price inflation discussed earlier. These two factors will be a drag on the operating leverage that companies derive from the topline acceleration expected in FY22.

RBI flattens the curve

RBI announced a new bond-buying programme called the G-SAP*, giving the OMO mechanism a new colour. The bond market reacted positively to this, and the 10-year gilt is now settling at the 6% level vs 6.25% peak on 10 Mar 2021. This is an incremental positive – it addresses the worries over rising yields potentially slowing the macro recovery. It also acts as a signal to the market that the RBI will use a range of tools to keep interest rates in check till growth bounces back to trend levels, at least. (*G-SAP: Government Securities Acquisition Programme)

The currency markets reacted adversely on that day with a single-day 1.5% correction. We do not think that this portends a general weakness in the rupee, which has been one of the best-performing emerging market currencies this year. A moderate current account deficit and continued equity capital flows should ensure continued stability. This would, in turn, provide support for the equity markets.

No hasty portfolio action

Our approach remains largely unchanged. We remain fully invested and are deploying fresh money as quickly as possible. We are slowly adjusting our portfolio towards more cyclical industries, where we find the scope for earnings upgrades the most likely – without compromising our filters for strong balance sheets, cash flows and profitability. We may tactically look at paring our exposure to sectors that are vulnerable to the second Covid wave, but any deep correction in quality franchises would make us buyers rather than sellers.

Source– Alchemy Group Research