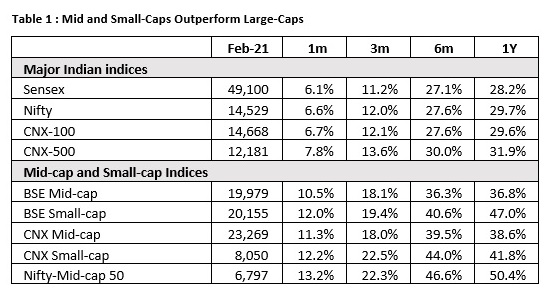

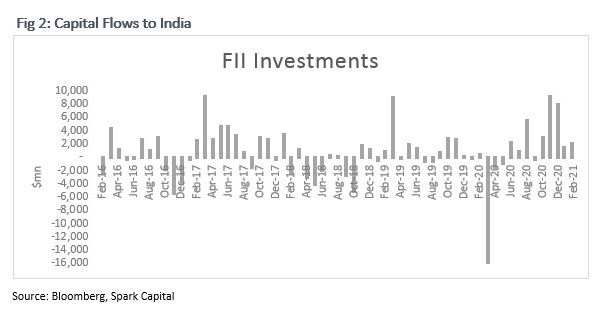

Buckle up for a choppy month - 18 Mar 2021

We expect increased market choppiness in March after the relentless one-way upswing for almost a year. Some near-term headwinds are building up: rising yields both in India and the US, rising COVID infections and commodity price pressures.This looks like a temporary blip – and we expect normal service to resume in 1QFY22, led by strong flows, economic recovery and earnings momentum. Our approach remains unchanged – we are minimising cash, focusing on quality names that are potential winners in the new economy. We will try to adjust our portfolio to favour cyclicals when the volatility gives us an opportunity. Investors with sub-optimal equity allocations should use any deep corrections to increase their exposure.

Near-term challenges

Rising yields

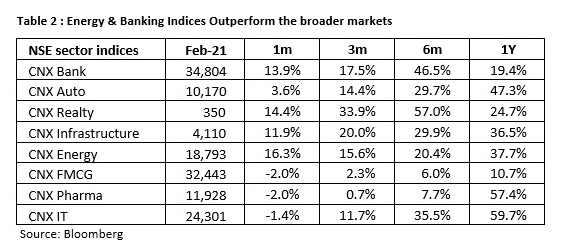

Long-term gilt yields have spiked, both in India and the US. Though they are part of similar narratives, they pose differing risks to Indian equities.

-

The stress in the domestic bond market is escalating. The frequency of failed gilt auctions has intensified in recent weeks and the stress has spilled over into the corporate bond market. We think this is temporary. The RBI is trying to manage yields while market participants, especially banks, are wary ahead of the March year-end. This is likely to be a temporary phase and the market should settle down in a few weeks, albeit with yields moving higher.

-

Rising local yields has twin impact a) squeezing private borrowing costs and slowing growth and b) hurting bank balance sheets. We are, however, far away from any of these risks crystallizing, especially because short-term rates have remained soft. Banks have also been cautious with their investment books and have enough cushion to deal with potential losses in their bond books. Private borrowing costs are unaffected, as was evident from banks cutting home loan rates in the same week as bond yields spiked.

-

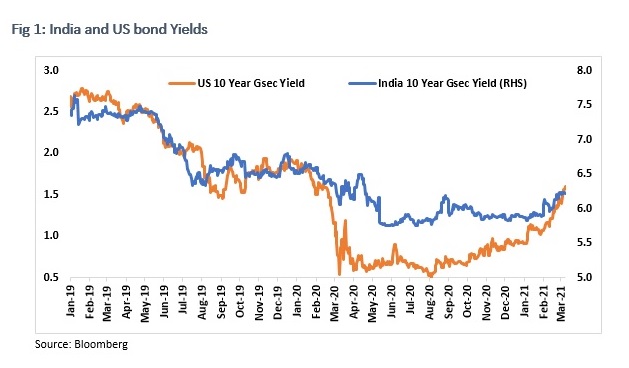

Hardening US yields could hurt flows to emerging markets and India, and that is a large potential risk to the markets. We, however, take comfort from the US Fed remaining steadfastly dovish, which would negate the impact of rising yields and sustain the capital flows. After months of sustained flows, a few weeks of disruption is unsurprising and does not indicate a trend reversal.

Covid worries

There has been a spike in Covid cases in some states like Maharashtra. This is a worry, given the “second surge” in some Western countries. We, however, think that there are mitigants. The new surge seems to be less lethal with a larger share of asymptomatic cases. The government response has also been more measured and a total lockdown looks unlikely. There could be some short-term impact on consumption and delay in the recovery in some service sectors, but we do not see the macro recovery getting disrupted. The increased pace of vaccination implies that we are not very far away from a return to full normalisation in the post-Covid era, likely in 2HCY21.

Commodity price pressures

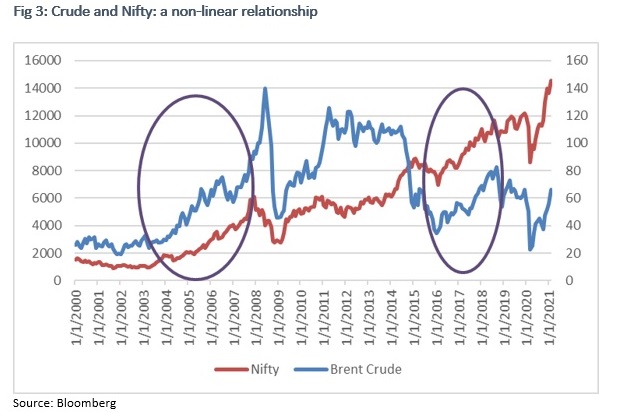

Commodity prices have been surging through this period and are now starting to make a significant impact. For India, the biggest worry is crude. We are not yet at the level that could destabilise India’s macro, but persistent crude prices in the US$80-100 range would pose a challenge. There are some offsets, however. India’s current account deficits are still benign, even adjusting for the low GDP growth in recent years. Moreover, the government has remained disciplined about passing on the rising crude prices to consumers (perhaps excessively so) to limit the impact on the fiscal deficit. Inflation will be affected, but the RBI is indicating that it will not rush to tighten until it believes the pressures are long-lasting. Historically, Indian equities have been resilient to rising crude prices in the early stage of the cycle but reverses beyond a “tipping point”.

The India story remains strong

Despite these challenges, we remain constructive on the Indian markets. The short-term disruptions are unlikely to hinder the number of long-term drivers that are in play.

Economic recovery

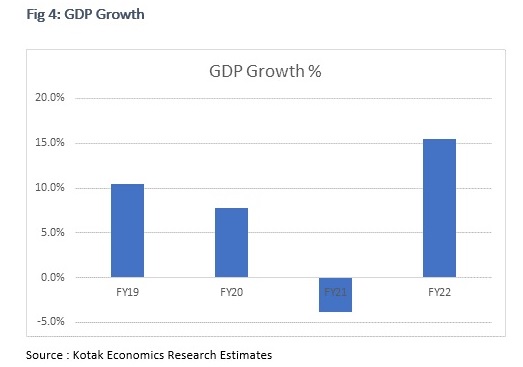

The economy has bounced back from the post-COVID lockdown and the momentum is likely to sustain. As we have discussed earlier, we see a continued K-shaped recovery for the next few quarters driven by improved consumption from the relatively affluent segments. The growth should become more broad-based by FY23, as the capex cycle kicks in – helped by expansionary fiscal policy, global growth,and the turnaround in India’s real estate cycle. The elevated FY22 growth (from a low-base effect) is likely to convert into strong momentum and we see India sustainably grow at 6%+ from FY23 onwards. Low cost of capital, higher government capex, and sustained consumer demand creates the platform for continued high growth.

Structural reforms

The FY21 budget, announced on 1 Feb, heralds the beginning of a new stage of structural reforms. The government had already started off liberalisation in key sectors like labour and agriculture immediately after the lockdown. The budget took that to the next level with a comprehensive privatisation plan, which included banking. This is accompanied by increased support to domestic production. The new economic philosophy was reinforced by the Prime Minister’s repeated statements on the objective of getting the “government out of business”. The combined effect gives the government fiscal headroom to continue a sustained capex programme and helps unlock macro productivity by privatising inefficient assets. Of course, the execution on these, especially privatisation, will take some time but the markets will start to discount this early. We see the potential for India to get a greater share of emerging market flows as the reforms take shape.

Earnings upgrades

A common concern on Indian markets is that the previous decade saw a sustained PE rerating without any significant earnings growth. That could change in the coming years – we are already seeing many cyclicals showing signs of a recovery. The consensus Nifty EPS for FY22 has been upgraded by ~4-5% since October and FY23 growth is also looking robust. The recovery is being led by cyclical sectors such as select financials and industrials, and we think that it is the beginning of a multi-year earnings recovery.

Constructive on markets

We remain watchful but see no reason to change our overall approach to the markets. Our strategy remains built on these principles:

-

We are minimising our cash holdings and are deploying fresh money as quickly as possible.

-

We remain focused on high-quality companies with strong or improving balance sheets, proven market leadership and execution, robust return on capital and healthy free cash flows.

-

We are increasingly focusing on cyclical sectors. If the markets correct meaningfully in the coming weeks, we will use the opportunity to realign our portfolios further towards cyclicals.

-

We continue to be mindful of potential risks at both company and stock level; and will move quickly if the risk-reward trade-offs turn adverse.

Source– Alchemy Group Research