EQUITY MARKET OUTLOOK - 12 Jul 2021

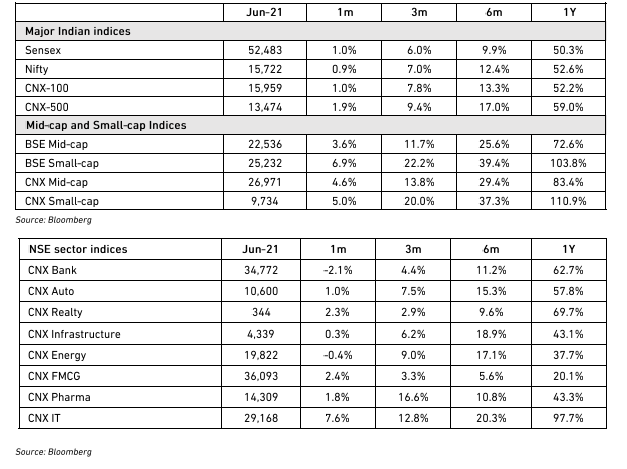

The markets had a quiet June, with the Nifty flat (+1%) and defensive sectors like IT and FMCG outperforming – banks were the major drag. The lull could last for some time, but we believe this is a pause in a longer bull market driven by a strong economic recovery and earnings improvement, especially in cyclical sectors. This month, we look at key macro trends and the upcoming earnings season.

Macro trends

-

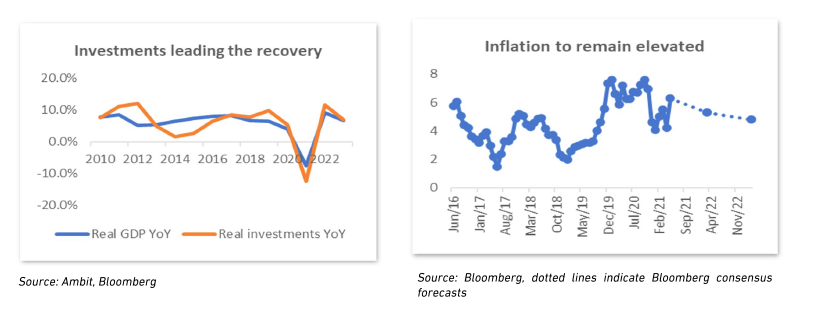

We expect a strong growth recovery with consensus estimates pegging FY22 GDP growth at 9.2%, despite the drag in Q1 from the second pandemic wave. Income growth should remain unbalanced with a larger negative impact at the bottom of the pyramid. We expect investment growth to be a key driver of the recovery, with consumption catching up with a lag.

-

Inflation should remain sticky, primarily led by supply-side bottlenecks in commodities unable to catch up with global demand recovery. This will cause bouts of nervousness for the markets, but we believe that RBI (and global central banks) will look through the near-term inflation pressures. This situation, largely, benefits industrial companies over consumer companies, who will have to deal with some near-term margin pressures.

-

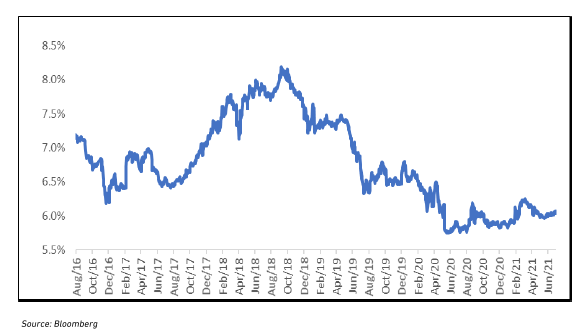

We see stable interest rates in the next few quarters. Policy action on rates are unlikely, and the RBI will continue to actively manage benchmark yields in the face of rising fiscal deficit. Short-term rates are likely to remain soft as liquidity remains easy in the foreseeable future. Of course, we are at the bottom of the cycle from a 2–3-year perspective, but the upmove is not imminent. Muted bank credit growth would be offset by disintermediation, and we do not see any availability of credit as a growth constraint.

-

The government’s willingness to relax its fiscal deficit targets has been one of the policy positives of 2021. The fiscal deficit is likely to remain elevated through FY22 and FY23 but we believe that there will be revenue buoyancy from 2HFY22 – tax collections could surprise the street on the upside. This could trigger a cascading positive impact on financial markets, even while inflation is elevated.

Earnings outlook strong, valuations supported.

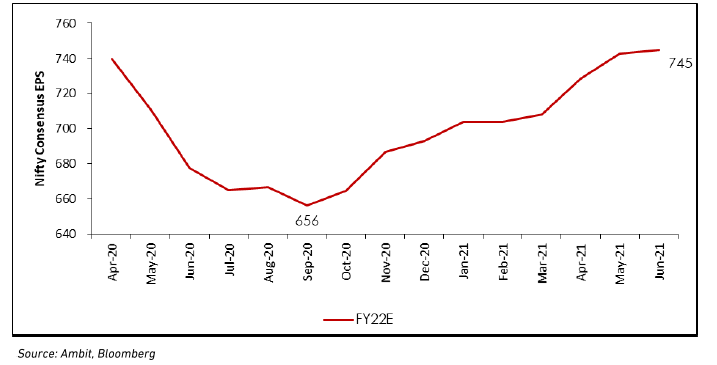

Consensus upgrades stabilising

Consensus estimates peg strong Nifty EPS growth ~30% p.a. through to FY23, based on the broader economic recovery and upturn in cyclical companies. This washes out the low base of FY21 and is one of the supportive factors behind the strong markets in CY21 so far. The key drivers of the growth are the post-lockdown topline recovery, operating leverage, gains from the cost efficiencies achieved in FY21, reduction of bank NPAs. The upgrade cycle for FY22 has taken a pause due to the second wave and risks from rising commodity prices, and the street will be looking at the Q1 22 earnings season for further cues.

1Q21 earnings – look out for margins.

The extended Q4 20 calendar has taken us to the doorstep of the next round of results. Consumer companies’ margins will be in focus as they have to cope with the spike in commodity prices. The trend is known but the quantum will become clearer in the earnings releases. There could also be a drag on topline growth due to the second wave, but that, again, is known – future demand assessment will be tracked more closely. Banks and NBFCs could see some upfront NPL recognition and provisioning – we think the market will reward conservative accounting. Finally, commodity companies could see strong momentum despite the plateauing of global prices because domestic price hikes came with a lag.

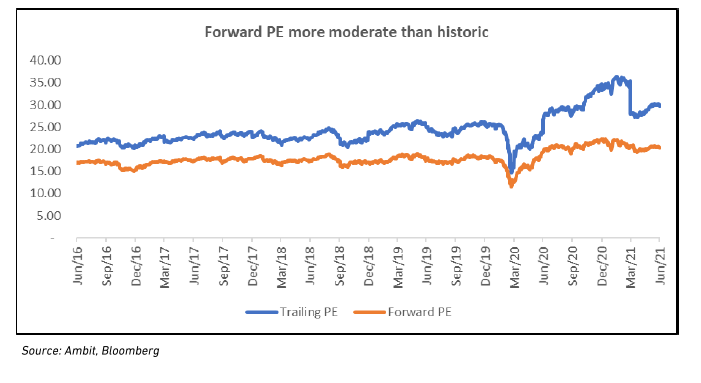

Valuations not a worry

We are sanguine about the apparent stretched headline valuations of the market for three reasons:

-

Trailing valuations are a function of the depressed FY21 earnings – the significant gap between trailing and forward is an indicator that the market is pricing in a recovery and is ignoring the earnings hit last year.

-

Low interest rates and high liquidity have contributed to valuation expansion – and could be at risk when the rate cycle turns. However, when that happens, earnings growth would also bounce back and an upgrade cycle would kick in – one cannot happen without the other. We are addressing that risk with a higher exposure to cyclicals, where earnings growth is stronger than the expensive defensives and valuations more reasonable.

-

Longer term PE comparisons (5-10 years) are coloured by the changed composition of indices towards high PE quality growth stocks – they are a poor indicator of markets being over- or under-valued.

Stock-pickers’ market

We see this as a stock-pickers’ market – the secular trend may not be as supportive in the short term, but individual stocks and sectors offer significant opportunity. Our strategy remains unchanged – we are minimising cash positions, deploying fresh money as quickly as possible, continuing to pivot our portfolios towards cyclicals. Even as we do so, we remain focused on quality companies with strong cash flows and low or improving leverage. Market leaders with a sustainable competitive advantage and robust profitability remain a key filter for choosing our stocks.

Source– Alchemy Group Research