EQUITY MARKET OUTLOOK - 13 May 2022

RBI’s off-cycle rate hike surprised the market more on its timing than its actual action. It has been apparent from the beginning of CY22 that the rate cycle had bottomed out and a period of normalisation would soon begin. Beyond the immediate shock of the sudden announcement, we think a steady normalisation of rates and liquidity to pre-pandemic levels will be absorbed by the economy and the market. It does not change our thesis of a strong growth recovery and continued earnings momentum across the headline indices. We believe that the broader markets will remain volatile with muted upside over the next 12 months, but there would be opportunities in smaller sectors and individual stocks

More rate hikes to come

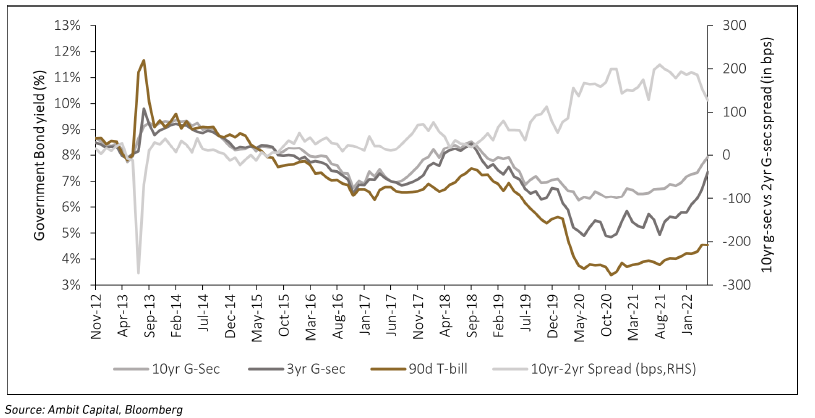

We see more rate hikes over the rest of CY22, with an exit level of 5.25% to 5.5%. We also expect more action on tightening liquidity, given it is significantly above the normative neutral. The impact is likely to be felt at the short end, though the 10-year could also push up beyond 7.5% by end-FY23. This could, of course, impact market rates across the board. Borrowing costs, especially for high-quality corporates, may move up significantly, as should term deposit rates.

In the larger context, the RBI is merely withdrawing the excess accommodation of Covid times. If we ignore the rate of change and focus on the levels, the repo rate at 5-5.5%, 10-year at 7.5-7.75% and the 1-year OIS at 5.5%-6% is, at best, middle of the historic range. These moderate levels of interest rates should neither hurt aggregate demand nor create balance sheet stress for corporates or individuals.

The withdrawal of the excess accommodation could, on the other hand, be positive for financial stability. The pressure on the rupee is likely to ease and the RBI may not be required to defend the currency as it had to for the past few months. If the RBI’s tightening measures do, indeed, stabilise the rupee, this could be a net incremental benefit for the domestic economy.

Impact on financials

-

In general, financials benefit at the beginning of the rising rate cycle. Liabilities reprice slower than assets, leading to a proforma NIM expansion for most banks. However, in the real world, increased competition eats away at some of these gains as banks cut their loan spreads in the quest for market share. The net impact would be a positive, but it could be smaller than the simple maths suggest.

-

This is also a period where quality deposit franchises start to stand out. Wholesale liabilities start to reprice faster than retail ones, and that sometimes eats further into the benefits of the natural margin expansion. Moreover, wholesale liabilities would gradually become costlier than retail ones.

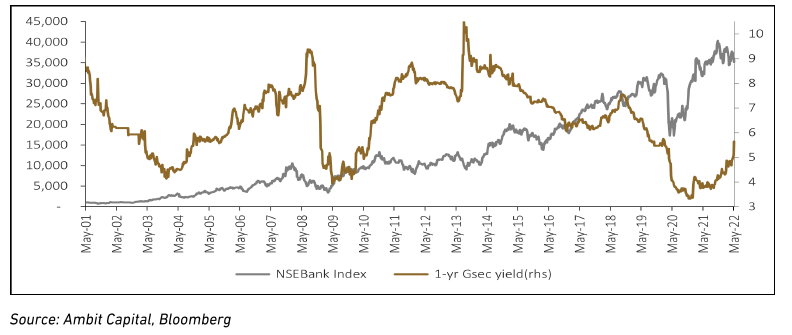

There is no clear correlation between interest rates and bank stock prices (see chart below). We believe that high-quality banks will remain resilient through this rate cycle and will not change our view on the sector because of the RBI action.

Impact on other sectors

Interest costs should rise, with high-quality borrowers seeing a bigger change as they move in tandem with short-term benchmarks. The impact would, however, be negligible given the ultra-low leverage levels in corporate India. Moreover, given our strong filters on leveraged companies, we believe that our investment universe is even more protected.

The second-order potential risk is on aggregate consumer demand. Despite rising household leverage, we believe that this would, also, be negligible. We see three factors mitigating the impact – a) competition will limit the transmission of these rates to consumers b) wage increases in the organised sector have been very strong, so affordability may not be affected and c) lenders can adjust by tools like increasing loan tenor to minimise the impact on borrower cash flows.

Earnings remain resilient

The positive is that broader earnings remain resilient through the macro headwinds. FY23/FY24 consensus forecasts remain largely unchanged through the last four months, with EPS growth forecasts in the mid-teens. This would represent the strongest three-year period of earnings growth for the Nifty in the last 10-12 years, as we have highlighted in our previous posts. None of the macro headwinds – the Russia-Ukraine war, high commodity prices and rising interest rates have a material impact on aggregate headline earnings.

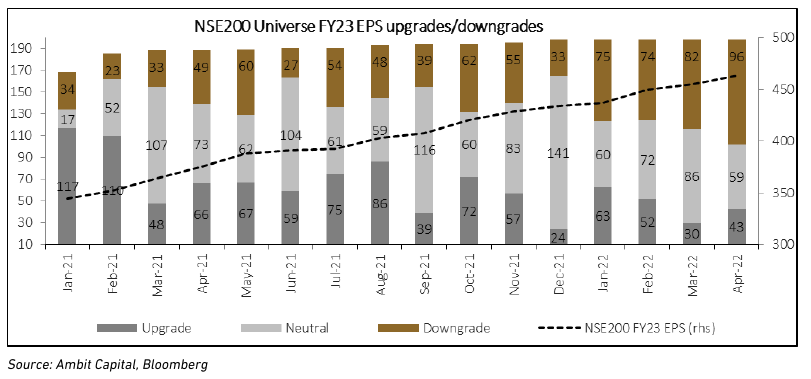

Smaller individual companies would however be hurt, as the next chart shows (refer chart below). Even as the headline Nifty EPS forecast holds firm, the pace of downgrades in individual companies is accelerating. Our focus, therefore, has been stock-specific and bottom-up with a strong focus on earnings and valuations.

Choppy markets ahead: follow the earnings

We expect the markets to remain volatile with limited upside for the broader market in the next year (low double-digits). The volatility may continue until the geopolitical risks and the process of normalising liquidity, both globally and locally, is done. However, we think that there are enough tailwinds for India’s broader macro – a full opening-up, strong rural economy and the capex cycle – to overcome these challenges.

Our strategy in this environment is to “follow the earnings''. In a market without any significant broad momentum, earnings growth will be the key driver of stock prices – finding rerating candidates will get increasingly tougher. Of course, the sustainability of the earnings growth will also have to be considered – strength of balance sheet and cash flows, longer-term competitive advantage and management quality – but these are qualifying factors rather than stock price drivers by themselves

Source– Alchemy Group Research