EQUITY MARKET OUTLOOK - 10 Oct 2022

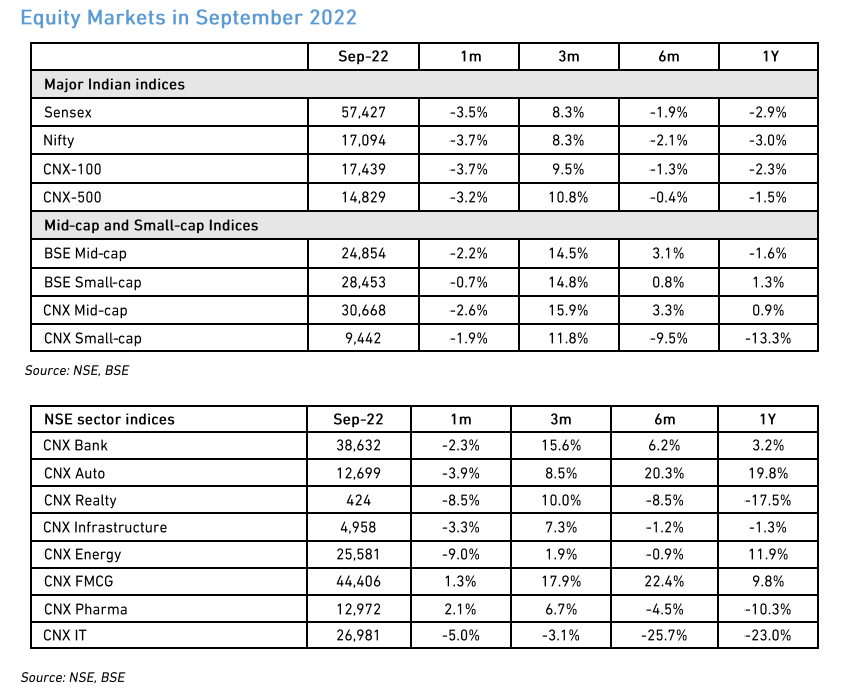

The Nifty corrected 3.7% in September 2022 after a strong 19% rally between 19-Jun 2022 and 15-Sep 2022. The sell-off was largely triggered by global factors like continuing tightening by the Fed and instability brought on by Britain’s mini-budget. We believe this noise could continue for 1-2 quarters, but the Indian market should remain strong beyond that. The tailwinds from strong domestic macro, resilient earnings and continued financial stability underpins our optimism. In the short term, however, we see the markets responding to some key events and trends – we list some of these in our blog this month.

Global Markets

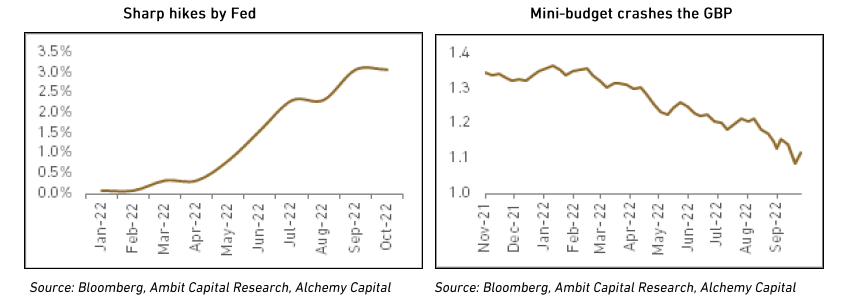

September 2022 month was dominated by global events. The US Fed announced a 75bps hike on 21-Sep 2022, with commentary that indicated continued tightening. This has raised the risk of a US recession and the markets turned understandably nervous. The mini-budget from the UK, effectively widening the fiscal deficit, sent stocks, bonds and currency into a tailspin – this was subsequently rolled back on 3-Oct 2022. The energy crisis in Europe shows no sign of resolution, forcing governments to provide fiscal support to beleaguered consumers as winter approaches. We believe that Indian equities have absorbed a large part of the global shock already – going forward, these may drive some short-term volatility but are unlikely to break the trajectory of the market.

We draw comfort from India’s resilience to the headwinds so far, but an extreme event puts that at risk. The worries around the state of some European banks are one such example, but we note that these are unsubstantiated rumors up until now.

Domestic Financial Markets

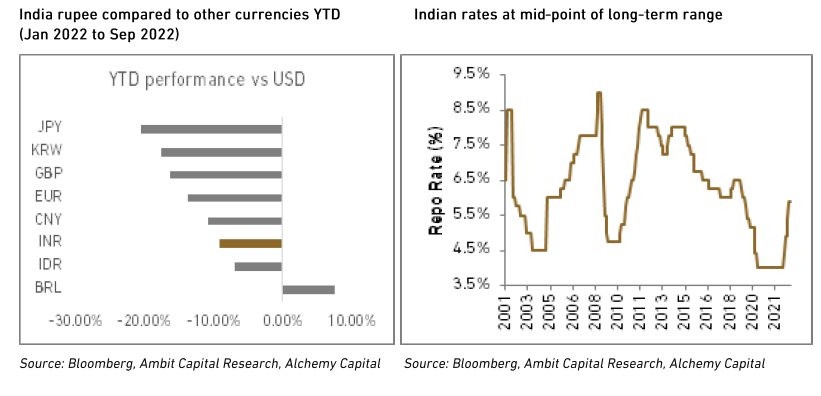

The Indian currency and money markets encountered their fair share of volatility too. The RBI raised rates by 50bps on 30-Sep 2022, though their tone seemed more benign for future hikes. The currency felt the impact of the global dollar rally and fell by 2.3% during the month. We do not see these impacting the medium-term outlook for equities. Despite the 190bps rise in the repo rate from the bottom, rates are still at the mid-point of the long-term range and unlikely to affect domestic demand or corporate balance sheets. The rupee weakness is also not alarming – it is outperforming other currencies, the current account deficit is lower than historic highs and the worst of the capital account pressure is probably done. Follow the links for more detailed discussions on the impact of interest rates and the currency on Indian equities in our previous blogs.

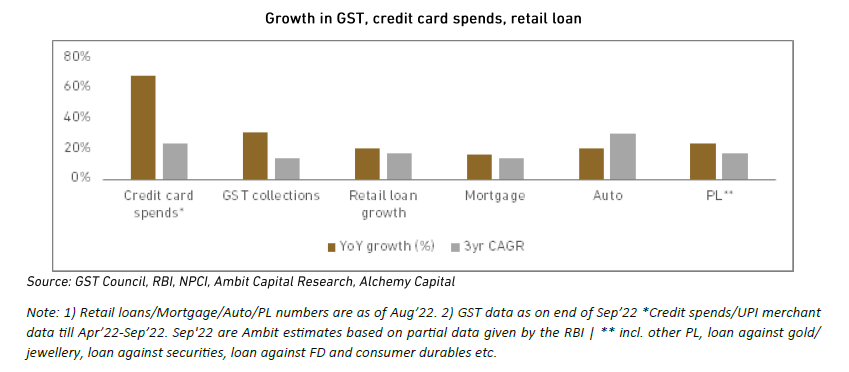

Aggregate Demand Trends

We see resilient demand as a key reason for being positive about the markets. The ongoing festival season should test that assumption, and we are closely watching the trends. The initial anecdotal feedback has been positive, with reports indicating a strong response to the initial sales by online shopping portals. Some hard data like credit card spend is supporting the thesis of strong demand. The next few weeks will reveal more and set the tone for the demand scenario over 2HFY23. The only weak spot could be mass segment demand, where consumers seem to be still suffering from the effects of high inflation, despite the recovery in employment levels.

2Q Earnings Season

We enter the 2Q earnings season and we are following some key trends as an indicator of the earnings trajectory for FY23/FY24.

-

Top-line growth, of course, will be the key factor. For consumer companies, we expect strong growth but we shall be following the numbers for industrials as well. Management commentary around the festival season demand and the outlook for 2HFY23 would be critical.

-

The impact of the weakness in global commodities is important. The benefit may not be visible immediately in 2QFY23, as existing inventory could be written down. Management commentary would be crucial, on whether the companies enjoy the margin relief or choose to pass it back on to the consumers.

-

Mainstream IT companies have underperformed calendar year 2022, due to high initial valuations and demand uncertainty as recession looms in the US. Commentary around their resilience would be keenly followed, and any positive surprises could see some relief for the sector. We aren’t holding our breaths though – we would rather wait for concrete evidence of the demand outlook than jump in too early.

-

Asset quality trends from banks are critical to the broader markets, too. The risk-off strategies post-pandemic, combined with conservative provisioning, are leading to a very benign FY23. The sustainability of the trend is key to supporting this sector after the sharp rally in CY23. We are positive on medium-term NPL trends but remain watchful for any risks.

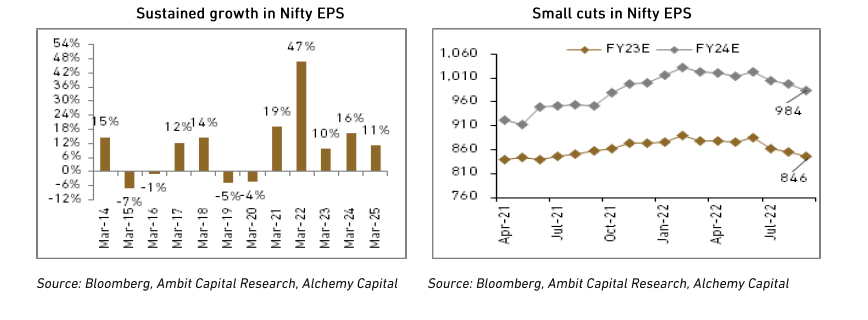

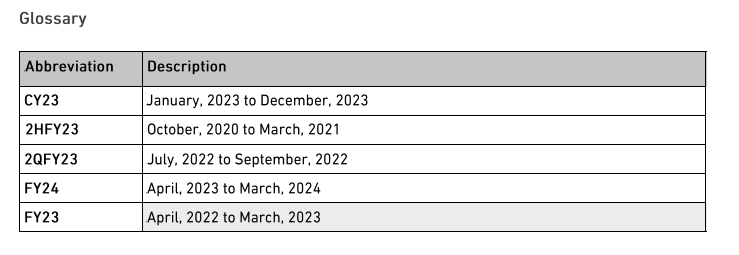

The earnings outlook for the market has stayed resilient and the Nifty EPS has held up well after some cuts in early 2QFY23. We see this continuing and, if demand holds up, the possibility of further upgrades to FY24 consensus.

Stay Invested

We would urge investors to avoid timing the market and stay invested to the extent of their strategic allocation to equities.

Source: Alchemy Group Research, Bloomberg

Disclaimers

Information and opinions contained in the document are disseminated for the information of authorized recipients only and are not to be relied upon as advisory or authoritative or take in substitution for the exercise of due diligence and judgment by any recipient. This document and its contents has not been approved or sanctioned by any government authority or regulator.

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer or solicitation will be made only by means of the appropriate confidential Offer Documents that will be furnished to prospective investors. Before making an investment decision, investors are advised to review the confidential Offer Documents carefully and consult with their tax, financial and legal advisors. This document contains depiction of the activities of Alchemy and the investment management services that it provides. This depiction does not purport to be complete and is qualified in its entirety by the more detailed discussion contained in the confidential Offer Documents. Any reproduction or distribution of this document, as a whole or in part, or the disclosure of the contents hereof, without the prior written consent of Alchemy, is prohibited.

Performance estimates contained herein are without benefit of audit and subject to revision. Past performance does not guarantee future results. Future returns will likely vary, and investment results will fluctuate. In considering any performance data contained herein, prospective investors should bear in mind that past performance is not indicative of future results, and there can be no assurance that the Fund will achieve comparable results or that the Fund will be able to implement their investment strategy or achieve their investment objectives will achieve comparable results.

The information and opinions contained in this document may contain “forward- looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “seek”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof. or other variations thereon or comparable terminology. Due to various risks and uncertainties, including those set forth under the Private Placement Memorandum/ Investment Agreement actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

These materials discuss general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, Alchemy does not assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date, and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. Alchemy’s opinions and estimates constitute Alchemy’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only

Performance results shown for the Fund are presented on a net basis, reflecting the deduction of, among other things: management fees, brokerage commissions, administrative expenses, and accrued performance allocation or incentive fees, if any. Net performance includes the reinvestment of all dividends, interest, and capital gains.

The net monthly return is derived by reducing the Fund’s gross performance by the application of the management fee, charged monthly in arrears, a subscription fee and a performance fee. The performance fee is charged annually and subject to a high water mark. Performance results are estimates until completion of the annual audit. Because some investors may have different fee arrangements and depending on the timing of a specific investment, net performance for an individual investor may vary from the net performance as stated herein.

Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, creditor other factors (such as number and types of securities) An index does not account for the fees and expenses generally associated with investable products. The S&P BSE 500 index is designed to be a broad representation of the Indian market covering all major industries in the Indian economy. The index consists of 500 constituents listed at BSE ltd. It is calculated using a float adjusted , market cap weighted methodology. The Rebalancing of the index occurs semi-annually in June and December.