EQUITY MARKET OUTLOOK - 08 Sep 2021

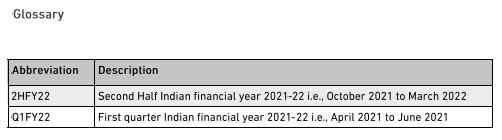

August 2021 was a strong month for the Nifty (+8.7%) with IT, FMCG and Energy leading the rally. There was some volatility, especially around the scare of a Fed taper, but that quickly dissipated on the back of a recovering economy and strong earnings momentum. We remain positive on the markets and believe that the current strength, led by cyclicals, exporters, and opening-up beneficiaries, will continue for a while longer.

Impact of US Fed Tapering

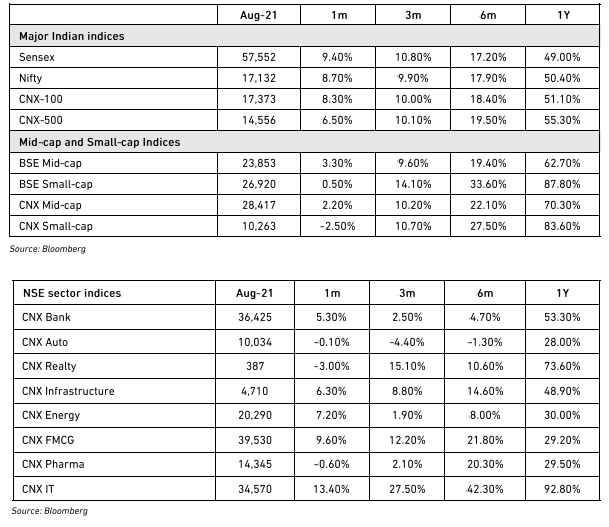

We think this is a red herring – historical data shows that Indian equity markets have often delivered strong returns through a tightening cycle. Rising interest rates is generally a negative for PE multiples but is usually accompanied by a recovering economy which drives earnings growth and upgrades.

The federal tapering is bound to tighten at some stage, and this could create short-term market volatility. However, the more important driver for the markets is domestic growth and how it translates into corporate earnings. We focus more on monitoring the broader economy and companies than we do the rate cycle.

India Macro drivers

India is coming out of the macroeconomic slump induced by the Covid19 shock, and remnants of the stress are still visible. The post-lockdown recovery has been concentrated on higher-income segments (K-shaped) and the impact of the second wave on consumption behaviour is still unknown. There are, however, significant positives and we believe that the recovery should start to take hold as we enter 2HFY22.

-

India’s GDP print for Q1FY22 was weak – the headline 20.1 % growth distorted by a base effect. This was largely the effect of the second wave of the pandemic, which had its most severe impact during this quarter. From a market’s perspective, this is not a very critical statistic: corporate earnings for the quarter have already given us a view. The important drivers for the market would be the opening-up recovery and the segments that participate. An important factor would be how quickly does the K-shaped recovery broaden into broader consumption growth.

-

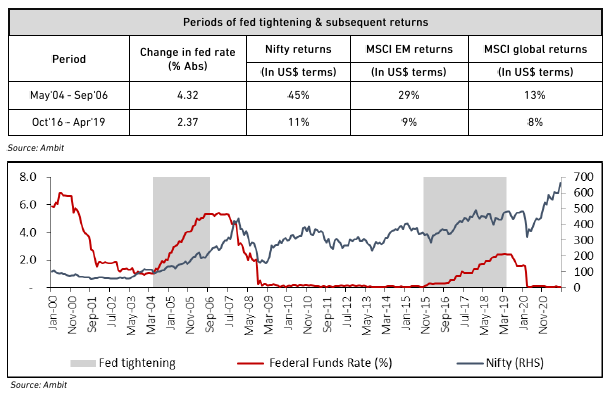

Government finances are in good shape. The fiscal deficit is at a mere 21.3 % of the annual target, significantly lower than usual (see chart below). Tax revenues, especially GST, have driven it. - The shift in approach to a looser fiscal policy in the 2021 budget means that the government can increase spending. We believe that capex spending – both public and private – will drive the next recovery cycle.

Inflation remains an overhang, induced by surging global commodity prices and supply chain choke-ups. We think this should remain elevated for some more time, as some of the constraints are unlikely to go away quickly. However, we believe that central banks will look through this phase and will begin tightening only when growth starts to return. This does raise the risk of sticky inflation over the longer term, but it is a risk that should be taken.

Reform Momentum

The government has accelerated reform momentum in its second term after its re-election in 2019, with the 2021 budget being a watershed moment. Some of the announcements are now being executed. This remains a positive for markets as these will unlock efficiencies for the economy and improves long-term growth.

-

The asset monetisation plan, announced in Aug-21, has multiple long-term positives. First, it unlocks government assets and creates a continuous flow of finances for the central government to re-invest in further infrastructure investments. Second, it improves the efficiency of those assets as they will be better managed by the private sector. Third, it could be the catalyst for the long-term bond markets. Investors have been wary of funding infra projects as implementation risks are too high to be digested. These, however, will be steady cash-flow generating assets and the reduced risk could attract the vast pools of capital hunting for yields. However, speed of execution will be very critical.

-

The appointment of bankers for the IPO of LIC is also significant. The issuance is a major fillip to the aggressive disinvestment and privatisation program of the government. True, some of the privatisation projects have been slow – we think that they could further take more time. However, the listing of a large company like LIC has benefits beyond just the cash flows it generates from the government. It deepens the markets, makes a large financial institution more transparent and signals the government’s seriousness on privatisation.

-

Other reform measures from the government like labour, farm and electricity are operating at different speeds. The totality of it, however, should unlock significant potential growth for the economy over the longer term. It is also encouraging that the government does not seem to be taking a step back from these reforms even when faced with political backlash.

Timing the markets is risky

We remain constructive on the markets and believe that the momentum should continue for a few more quarters as the goldilocks scenario of strong US economic growth coupled with a slow unwinding of stimulus. Any geopolitical events or a sudden unforeseen spike in inflation could be the near to medium term risks.

We reiterate our view that cyclicals, exporters, and opening-up trades should continue to outperform, though some high-quality consumer names remain attractive from a longer-term perspective. We are fully invested and deploying fresh inflows at an optimum pace we do not see any benefits of trying to time the markets at this stage. Our portfolios have been significantly re-positioned to reflect our thesis and we remain flexible to adapt if the situation warrants.

Source– Alchemy Group Research